As a CPA and business advisor to medical practices, I am often called to diagnose the cause of financial underperformance. Common themes emerge as these conversations unfold:

“I am working harder every year.”

“Everybody in my office gets a raise every year except me.”

“Our health insurance goes up 10% or more every year.”

“Just when I think I am getting ahead, something always pulls me back. Last year, the AC went out, this year I have to buy a new server.”

“These compliance costs are out of control!”

Does this sound familiar? Of course it does, because no one is immune to the rising cost of everything. As a result, many practices manage expenses reasonably well but pay far less attention to the most important number on their profit and loss (P&L) statement—their revenue.

Why Is Revenue So Important?

If you take the position that the biggest numbers matter most—a fairly noncontroversial statement—then revenue ought to grab your attention before any other number on your P&L. More importantly, you can exert more control over revenue than any expense. This is truly a good thing, because if you can maximize revenue, it will have a far greater effect on your financial success than any expense cut you attempt.

Understanding Fixed and Variable Expenses

One key to understanding the power of revenue is to also understand the distinction between fixed (the same no matter how many patients you see or how productive you are—such as rent) and variable expenses (varies with the number of people you see—such as exam gowns or gloves). (see our blog on Fixed Vs Variable Expenses)

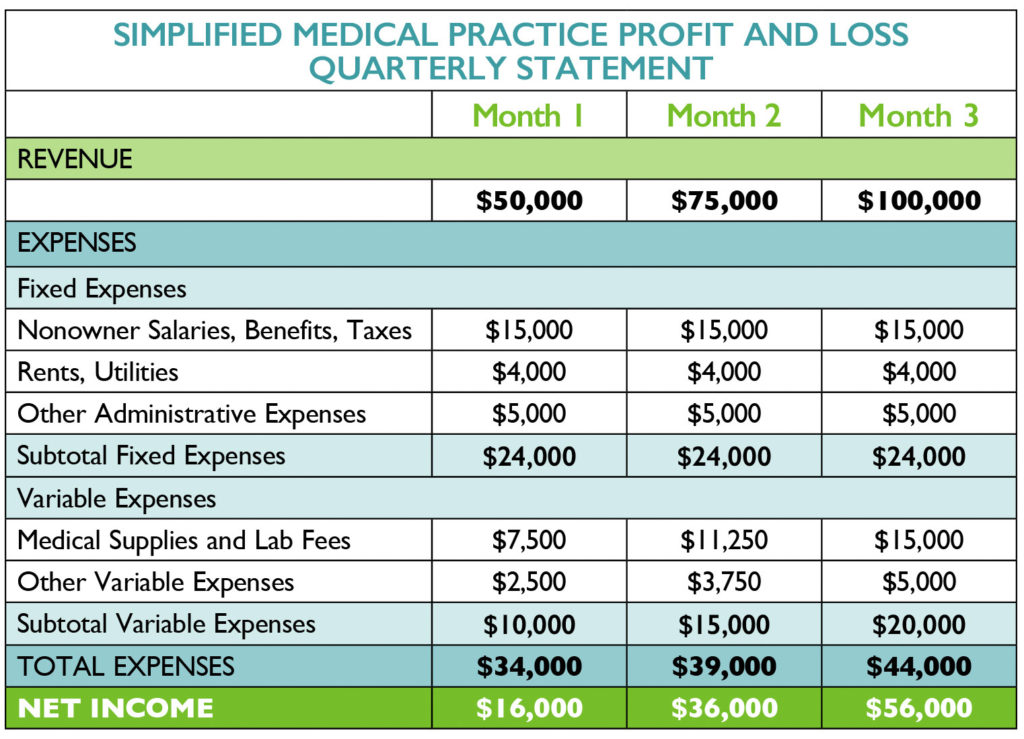

Why do fixed and variable expenses matter? As you review a listing of your common expenses, you will discover that most of these expenses are fixed. Once your revenue has paid for these expenses for the month, then a significant portion of the remaining revenue goes straight to your bottom line (see the chart below).

In this illustration, revenue increases $25,000 per month over a three-month period. Fixed expenses are the same each month, and variable expenses are 20% of revenue. Once the fixed expenses are paid, 80% of the remaining revenue goes to net income. No amount of cost-cutting comes close to affecting profits as much as increasing revenue.

Driving Revenue

Although revenue drivers vary depending on the nature of your practice, several common considerations should guide your actions:

- How do patients find you?

- Is your practice referral-based?

- Does a spiffy website and strong social media presence matter?

Once you figure out what drives patient volume, you can plan about how to improve in those areas and set realistic financial goals. Knowing what you are earning for your hard work is a great way to fight burnout.

Consider how much you are able to control pricing as well. Depending on your specialty, you may have very little ability to set your pricing or a great deal of latitude in this area. If you are a fee-for-service provider, try to raise prices every year, even if just incrementally. If you have not raised prices in a while, research the market to determine whether you are in or out of step with the market. If you are at the top of your game, don’t be afraid to ask for a premium.

If your practice is predominantly insurance-based, analyze fees by provider. You may be able to trim a few lower-margin providers to free up slots for higher-margin visits.

Set production targets for you and your team and monitor your performance regularly. You are more likely to improve in the areas that you target and measure.

by Trey Whitt, Partner, DentMoses, LLP, Birmingham, AL

Follow us on Twitter, Facebook, and LinkedIn to join the conversation about accounting for medical practices.