Effective Analysis of Your Practice Financials—Think Big, Then Small

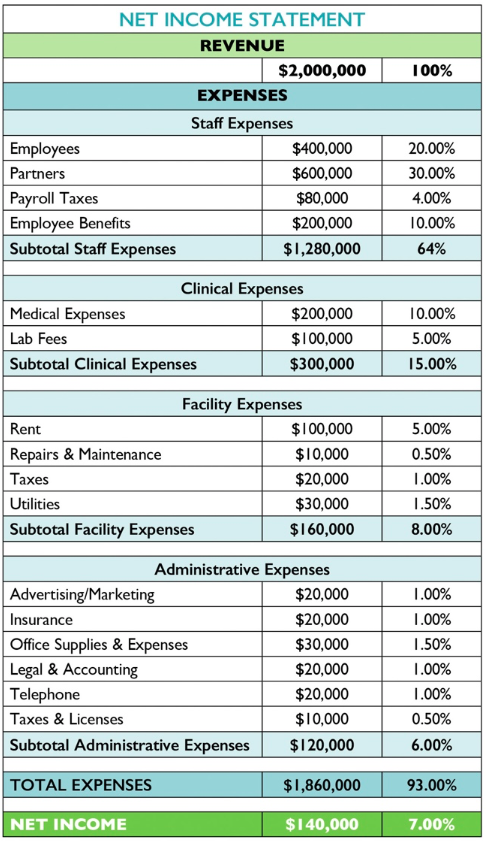

A typical profit and loss statement may contain 30 or more different expenses categories, making it easy to get lost in the little details when searching for the things that matter most to your financial success. In the post Why Revenue Matters Most, I explained why revenue is the more important number on your P & L. While this is true, you must also pay careful attention to how you spend that revenue in order to maximize profits.

Getting out of the Weeds

Instead of culling 30 expense accounts for the items that matter, consider stratifying your expenses into broader categories and comparing your performance in those categories to industry standards or internal benchmarks. Here is how that looks:

If you determine net income ought to be $200,000 instead of $140,000, administrative expenses are probably not where you need to focus, at least not initially because only 6% of your revenue is spent on administration. Even if you decrease that to 5%, which would likely require a deep dive into multiple subcategories of administrative expenses, that would be only a $20,000 savings. Instead of that very inefficient and unsatisfying use of your time, in this example, you are probably better off taking a closer look at your staff and clinical expenses because these are the areas where the most money is being spent.

Short- vs Long-Term Expense Planning

Stratifying your expenses also illustrates which expense categories are controllable in the short term versus those that will require a longer-term approach. For example, if you determine that you would like to cut $30,000 from your employee benefits package, you may be able to do that fairly quickly with a careful analysis of what those benefits are, how valuable they are to your employees, and which ones you can purchase more efficiently.

On the other hand, if you are trapped in a bad lease that runs another three years, you are likely stuck with those rents for a while. Nonetheless, having a financial statement that draws your eye to that expense will help you plan for a better outcome in your next lease negotiation.

Conclusion

Moving from where you are to where you want to be, financially requires you to focus on the big expenses first. One key is formatting your profit and loss statement to draw your attention to those items.

Don’t forget to check your Balance Sheet Basics either!

by Trey Whitt, Partner, DentMoses, LLP, Birmingham, AL

Follow us on Twitter, Facebook, and LinkedIn to join the conversation about accounting for medical practices.

Dr Hemp CBD Oil Reviews

Do Physicians Know How To Analyze Financial Statements?